Selling a Short Lease Flat?

How to check if you own a short lease flat? Find out now using the Land Registry’s Find a Property Service

Many of the “short lease” enquiries we receive are from flat owners who have either decided to ignore the ticking time bomb of their expiring lease or just haven’t known because no one has told them, until now. To many it comes as a surprise and seems unfair to know that the property they paid £200,000 for 20 years ago is now worth half of that amount because the lease term has been allowed to run to a dangerously low.

It’s important to know the obligations and risks of buying a leasehold flat; often the most forgotten about is the problem of running into a short lease. If you’re not sure how many years remain on the lease for your flat, the quickest way to find out is to check on Land Registry’s “Find a Property Service”. From here (for a nominal fee) you can download the lease title document for your flat. Make sure you download the leasehold title and not the freehold. Note that this is not your lease, but a title document. Your lease is a separate document which can be obtained from Land Registry or your mortgage company if you have a mortgage. The title document will give details of the date the lease was issued and it’s term. The term will usually be either 99 years, 125 years or 999 years. To work out approximately how many years remain on your lease take the start date, add the term and then subtract this years date e.g. lease start date 1976 ADD 99 years SUBTRACT this year 2016 = 59 years. So in this case there are approximately 59 years remaining on the lease.

It’s important to know the obligations and risks of buying a leasehold flat; often the most forgotten about is the problem of running into a short lease. If you’re not sure how many years remain on the lease for your flat, the quickest way to find out is to check on Land Registry’s “Find a Property Service”. From here (for a nominal fee) you can download the lease title document for your flat. Make sure you download the leasehold title and not the freehold. Note that this is not your lease, but a title document. Your lease is a separate document which can be obtained from Land Registry or your mortgage company if you have a mortgage. The title document will give details of the date the lease was issued and it’s term. The term will usually be either 99 years, 125 years or 999 years. To work out approximately how many years remain on your lease take the start date, add the term and then subtract this years date e.g. lease start date 1976 ADD 99 years SUBTRACT this year 2016 = 59 years. So in this case there are approximately 59 years remaining on the lease.

What is a short lease?

When buying a leasehold flat you will not usually own the land the flat sits on. The land the flat sits on is owned by the freeholder. You as a leaseholder effectively have a contract with the freeholder, you both have responsibilities and obligations as set out in the lease, for example the freeholder will maintain the outside of the property and in return you will pay a service charge to the freeholder. The lease (like a contract) you have entered into has a start date and an expiry date. As time goes by the value of the lease reduces. Think of it like this: a contract for the use of an asset for 100 years is worth more than a contract for the use of an asset for 50 years.

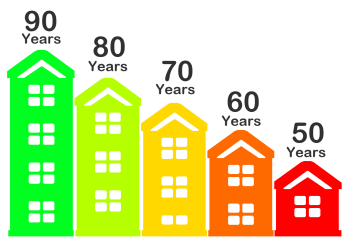

So as time goes by the number of years remaining on the lease reduces. As the number of years on the lease reduces the value of the lease reduces too.

A short lease is usually defined as a lease with less than 70 years remaining. It is at this point that most mortgage lenders will find it difficult to offer a mortgage. But since changes in legislation a number of lenders now consider a short lease as being less than 80 years, as this is the point at which ‘marriage value’ kicks in when applying for a new lease under the terms of The Leasehold Reform, Housing and Urban Development Act 1993.

What’s the problem with a short lease flat?

Generally speaking, you are better off extending the term (number of years) on your lease as early as possible. The relative cost is much lower and it can become unaffordable to extend very short leases. The problem comes when a mortgage company will not offer lending on a short lease property. But if you have owned the property for more than 2 years you will be able to sell your short lease flat passing on the right for the new owner to extend the lease.

Sell your short lease flat now...

Copyright

Registered with the ICO under the terms of the Data Protection Act 1998.

Registered address: 330 Linen Hall, 162 Regent Street, London W1B 5TD.

Company No. 04636129. ICO No. Z7733416.