How to Sell a Flat in Poor Condition

Selling an Flat in Poor Condition?

Selling a doer-upper flat? If you’re after a more reliable sale, we can make a direct offer – check out our buying code for details or request a free online estimate today.

Types of Flats

Disclosure

Renovate?

Sell Flat As-Is?

Valuing a Poor Condition Flat

Who Will Buy?

Typical Issues

Use an Estate Agent?

Steps to Take

Probate

Short Lease

London

FAQ’s

Free Estimate

Selling a Flat in Poor Condition in the UK

If you’re considering selling a flat in poor condition in the UK, it is essential to approach the process with a clear understanding of the challenges, legal obligations, and market expectations. Poor-condition flats are often described as fixer-uppers, refurbishment projects, or properties in as-is condition. These homes may be unmodernised, structurally unsound, or even uninhabitable, yet there is a robust demand for them among investors, cash buyers, and those seeking below market value (BMV) opportunities.

Selling a flat in poor condition presents a unique set of hurdles, but it can also offer a rapid and effective route to disposal, especially if a quick sale is your primary goal. Flats that need TLC, have outdated interiors, or suffer from serious defects such as water ingress, structural issues, or lack of compliance with building control standards are typically harder to finance via traditional mortgages. As a result, they attract a specific buyer profile: those who are experienced in renovations, have funding in place, and are prepared to purchase a property sold as seen.

Whether your flat requires a full renovation, is a derelict flat in shell condition, or simply needs modernisation, setting realistic expectations and targeting the right audience is critical. Understanding your obligations under UK property law is also key. Sellers are legally required to disclose material defects, and failure to do so could result in claims under the Property Misdescriptions Act.

From inherited probate flats that have fallen into disrepair to short lease properties with both legal and physical neglect, selling a flat in poor condition involves strategic pricing, accurate marketing, and often legal or structural assessments such as a structural survey, damp and timber report, or even planning permission or listed building consent for future work.

Ultimately, whether you’re navigating how to sell a flat in poor condition UK-wide or exploring the best way to sell a run-down flat in London specifically, it pays to understand the local market dynamics, buyer expectations, and legal requirements. Done correctly, selling a property that needs renovation in the UK can be both financially and logistically rewarding.

Selling a flat in poor condition in the UK can be a complex and technical process, but with the right strategy, it is entirely possible to achieve a successful sale. Whether your property is a derelict flat, a fixer-upper, or simply needs modernisation, understanding the challenges and your options is crucial.

Understanding Poor-Condition Flats: Key Types in the UK

When selling a flat in poor condition in the UK, it is vital to identify the specific type of disrepair or defect your property falls under. This classification will significantly influence how you market the property, the type of buyer you attract, and the legal and financial implications of the sale. From structural damage to aesthetic neglect, understanding the condition category will help you make informed decisions throughout the selling process.

1 – Structurally Compromised Flats

These are among the most severe and technically challenging cases when it comes to selling a flat in poor condition. Structurally compromised flats often exhibit serious physical defects, including subsidence, foundation movement, severe cracks in walls, sagging floors, or significant damage to load-bearing elements such as beams or roof trusses. These defects not only make the flat potentially unsafe but also render it unmortgageable in many cases. Mortgage lenders typically decline to finance such properties, as the risk is considered too high without a verified remedy plan. This limits the buyer pool to cash buyers only, which impacts the achievable sale price. When selling a structurally unsound flat, it is essential to obtain a recent, comprehensive structural survey conducted by a qualified structural engineer. This report will detail the extent of the damage and may include recommendations and an estimated cost of works for remediation.

Buyers of these types of flats are usually seasoned investors or developers who are well-versed in assessing risk and cost. Transparency is key – marketing the flat as a problem property or fixer-upper with full renovation required can actually attract the right type of buyer rather than deterring them. Additionally, sellers should consider legal advice to ensure proper disclosures are made under the Property Misdescriptions Act and Consumer Protection Regulations.

In terms of marketing strategy, emphasise the potential of the property once restored. Highlight factors such as location, square footage, or development potential (e.g. loft conversion or extension, subject to planning permission or building control approval). Selling a structurally compromised flat is not impossible, but it requires a strategic, honest, and technically informed approach.

Structurally compromised flats

2 – Flats with Damp, Mould, or Water Damage

Damp-related issues are among the most common problems encountered when selling a flat in poor condition. Persistent damp, rising moisture, black mould, condensation build-up, and untreated leaks can lead to significant structural decay, poor indoor air quality, and hazardous living conditions. These factors can render a property effectively uninhabitable, especially if mould growth has become extensive or if moisture has compromised the integrity of timber and plaster.

Flats suffering from damp or water ingress typically require a professional damp and timber report, which identifies the cause of the moisture – whether it’s rising damp, penetrating damp, or condensation – and provides recommendations for remedial action. Without this report, it is nearly impossible to reassure buyers or determine a realistic cost of works.

From an investor’s standpoint, flats with damp or water damage may be viewed as refurbishment projects or fixer-uppers with potential, particularly if the location is desirable. However, due to health and safety risks, mortgage lenders may refuse to finance the purchase, again narrowing the market to cash buyers only. When marketing such a flat, it’s essential to be transparent and include damp as a declared issue in the property information forms. Failure to do so could breach the Consumer Protection from Unfair Trading Regulations.

In many cases, resolving damp-related issues requires more than surface fixes. Structural work such as damp-proofing, replacement of affected materials, and sometimes even installing new ventilation systems or tanking basements may be necessary. As such, these properties must be priced to reflect both the visible damage and the unknowns.

Ultimately, selling a flat in poor condition that includes damp, mould, or water damage demands an honest and data-driven approach. Clear photographic evidence, independent specialist reports, and a willingness to cooperate with buyers’ surveyors will help build trust and facilitate a quicker, more straightforward transaction.

Flat with damp, mould or water damage

3 – Derelict or Abandoned Flats

Derelict or abandoned flats represent one of the most extreme forms of poor-condition property and often pose significant challenges when it comes to resale. These flats have typically been vacant for long periods and may have suffered from prolonged neglect, vandalism, or illegal occupation. In many cases, they are stripped back to shell condition – lacking kitchens, bathrooms, wiring, and heating – and are entirely uninhabitable.

Selling a flat in poor condition that is derelict requires a specific marketing approach. These are classified as problem properties, and their appeal is usually limited to seasoned investors, cash buyers, and developers with the resources to undertake a full renovation. Traditional buyers, particularly those requiring a mortgage, will find such properties inaccessible due to their uninhabitable state and the absence of basic amenities.

A structural survey and risk assessment can help buyers understand the scope of work involved and to provide a realistic cost of works.

Derelict flats are often sold as seen, meaning the buyer assumes full responsibility for the property’s condition without warranties. The price point is typically set well below market value (BMV) to reflect the extensive work required and the risks involved.

These flats may also come with other complications such as non-compliant alterations, planning permission issues, or the need for listed building consent before any improvements can be made.

For sellers, it’s crucial to provide full disclosure and be transparent about the flat’s history, condition, and legal status. Including clear photographic documentation and highlighting the flat’s potential – such as location advantages, floor area, or development possibilities – can help mitigate concerns and attract serious interest.

Derelict or abandoned flats can still be viable for sale if positioned correctly in the market. Selling a flat in poor condition of this type requires realistic pricing, legal due diligence, and a targeted approach that appeals to investors seeking refurbishment projects or long-term capital gains.

Derelict or abandoned flat

4 – Flats with Outdated Systems

Properties with outdated or non-compliant internal systems are a common example of flats that fall under the category of poor condition. These systems typically include antiquated plumbing, obsolete electrical wiring, inefficient heating systems, or the complete absence of modern ventilation. While such flats may initially appear habitable or visually intact, they often conceal significant latent defects that can be costly to remedy.

When selling a flat in poor condition that suffers from outdated systems, it’s important to understand the implications for compliance with current building control regulations. These regulations mandate certain standards for energy efficiency, electrical safety, and water management. If a flat has not been upgraded to meet modern standards, this can disqualify it from mortgage eligibility and may affect its Energy Performance Certificate (EPC) rating – further discouraging potential buyers.

Flats with outdated systems are ideal for marketing as fixer-uppers or refurbishment projects. They appeal to investors and buyers who are willing to undertake improvement works, especially where there is potential to increase the property’s value through renovation. These types of buyers are more likely to be cash buyers and may actively search for properties in need of modernisation.

For sellers, it is advisable to commission a basic survey or obtain quotes for upgrading key systems, as this will assist in pricing the property realistically. While the flat may not be uninhabitable, it is important to disclose the age and condition of the systems, particularly if there are known safety issues, such as outdated fuse boxes, lead pipework, or non-functioning boilers.

Ultimately, when selling a flat in poor condition due to outdated systems, clarity and transparency will help build buyer confidence. Highlighting the flat’s potential once modernised – along with any redeeming features such as layout, natural light, or location – can also increase its appeal as an investment opportunity.

Flat with outdated systems e.g. faulty heating

5 – Aesthetically Dated Flats

Often referred to as unmodernised flats, these properties generally require cosmetic upgrades rather than extensive structural or systems-based work. They may still retain old-fashioned fixtures and fittings, such as avocado-coloured bathrooms, outdated laminate flooring, floral wallpaper, or woodchip ceilings – features that are no longer in line with current buyer tastes.

While they may not pose serious safety risks or impact mortgage eligibility, aesthetically dated flats can be perceived as tired and unappealing. As such, they may struggle to achieve top market value unless the buyer is specifically seeking a refurbishment project. From an investment perspective, however, they present a relatively low-risk opportunity for buyers looking to add value through redecoration and minor upgrades. For example, new flooring, a modern kitchen, and a fresh coat of paint can substantially uplift the value and appeal of the flat.

When selling a flat in poor condition that is mainly cosmetically outdated, the marketing narrative should focus on potential. Label it as a fixer-upper or a flat in need of modernisation to capture the interest of DIY enthusiasts, first-time buyers on a budget, or investors looking for light renovation projects. Use language like “cosmetic TLC needed” or “great investment opportunity” to attract the right audience.

Sellers should also highlight redeemable features such as generous room sizes, natural light, original period details, or proximity to desirable locations and transport links. Staging the flat – such as removing clutter, deep-cleaning surfaces, and using neutral lighting – can also help prospective buyers visualise the property’s potential.

In essence, selling a flat in poor condition due to dated aesthetics is about positioning. The goal is to frame it as a blank canvas for transformation, while being honest about the updates required. With the right pricing and a focus on future value, these flats can attract significant buyer interest despite their outdated appearance.

Aesthetically dated flat

6 – Flats in Buildings with External Issues

Flats located within larger buildings often share structural elements and communal spaces with other leaseholders. These can include roofs, stairwells, external walls, lifts, communal windows, and entranceways. When these shared elements fall into disrepair – such as a leaking roof, crumbling brickwork, or broken communal doors – they can significantly affect the perceived and actual condition of your individual flat.

For anyone selling a flat in poor condition within such a building, one of the key issues is determining who holds responsibility for the external repairs. In most leasehold arrangements, the freeholder or managing agent is contractually obligated to manage and maintain the building’s structure and shared areas. However, the costs of these repairs are usually passed down to leaseholders through the service charge or via special one-off contributions, known as major works bills.

When marketing a flat in a block that suffers from external issues, it’s essential to be transparent about any known or upcoming works. If major works have been scheduled or proposed, you should disclose this to prospective buyers. Many buyers, particularly those using mortgages, will want to review Section 20 notices, reserve fund balances, and recent service charge accounts to assess the financial risk.

Selling a flat in poor condition in a building with unresolved external defects can be challenging, especially if mortgage lenders raise red flags during valuation. Buyers may be wary of unexpected costs or complications with building control compliance. To mitigate these concerns, you can obtain a copy of the building’s latest management pack and be proactive in answering questions about repair timelines, financial liabilities, and the history of maintenance.

In some cases, serious disrepair to shared areas may push a flat into uninhabitable or problem property territory, thereby requiring a cash buyer only approach. As such, sellers should understand their lease in full, seek legal advice if necessary, and prepare a clear breakdown of responsibilities before listing the property.

Ultimately, selling a flat in poor condition within a building that also has external maintenance issues adds an extra layer of complexity. However, by preparing the right documentation and being upfront about shared liabilities, sellers can still attract investors or informed buyers looking for opportunities in challenging but promising buildings.

Flat with external or communal area issues

7 – Legal or Title Issue Flats

Legal or title complications can significantly impact the process and timeline when selling a flat in poor condition. While these issues may not affect the physical integrity of the flat, they can deter buyers just as effectively as structural defects. Common problems include missing or unclear title deeds, unresolved disputes over boundaries or access rights, restrictive covenants, or complications arising from shared ownership or unregistered land.

In leasehold flats, additional complications can include absent freeholders, unapproved alterations breaching lease terms, or historic ground rent and service charge arrears. Such issues can delay or derail a sale, especially when a mortgage lender requires legal certainty before lending. If a flat has restrictions on resale, such as eligibility criteria under a shared ownership scheme, the pool of potential buyers can be dramatically reduced.

When selling a flat in poor condition that also has legal or title concerns, it is essential to engage a solicitor early in the process to identify and resolve these issues. Buyers will want legal reassurance, and any ambiguity around ownership or future obligations can lead to hesitation, price reductions, or even withdrawal.

Despite their non-structural nature, legal issues place flats firmly within the poor-condition category due to the barriers they create in completing a clean and efficient sale. As with all forms of property sales, honesty and transparency are critical. Sellers should disclose any ongoing legal matters and provide as much supporting documentation as possible to speed up conveyancing and reassure prospective buyers.

These flats are often best suited for cash buyers or investors who are familiar with resolving legal complexities and willing to take on the risk for a discounted purchase price. Selling a flat in poor condition with legal encumbrances requires careful navigation, expert legal support, and a realistic marketing approach that acknowledges the hurdles while highlighting long-term potential.

Flat with legal or title issue

We Buy Flats in Poor Condition

Wondering how much your poor condition flat could sell for? Request a free and no-obligation sale estimate today. Our direct offers are below market value, for a hassle-free sale with no fees.

Contact Us

Call our team on 020 7183 5114 or click the button below to request a free and no-obligation offer for your flat.

Do I Have to Disclose Everything That’s Wrong?

Yes, absolutely. When selling a flat in poor condition in the UK, legal transparency is not optional – it is a fundamental requirement. Sellers are legally obligated to disclose any known defects or issues under the Consumer Protection from Unfair Trading Regulations 2008, along with guidance from the (now-repealed but still influential) Property Misdescriptions Act 1991. These laws exist to protect buyers from being misled, and failure to comply can result in serious legal consequences, including financial penalties or even the reversal of the sale.

A key part of this legal disclosure process involves completing the TA6 Property Information Form. This standard document, used during the conveyancing stage, asks sellers to provide clear, honest, and detailed responses about all known aspects of the property’s condition. When selling a poor condition flat, this form becomes especially critical. It requires disclosure of:

- Structural problems

- Roof leaks or damage

- Significant damp, mould, or water ingress

- Japanese knotweed infestations

- Subsidence or ground movement

- Planning permission issues or breaches

- Violations of building regulations

- Title defects or access disputes

- Neighbourhood or leasehold conflicts

If your flat is uninhabitable, in shell condition, or qualifies as a problem property, this must be clearly communicated in the TA6 form and reflected in all advertising and buyer communications. Transparency here is not only a compliance issue but can also shape the buyer’s perception and decision-making process.

Honesty is especially vital when selling a flat in poor condition as-is, or when targeting cash buyers who often purchase on a “sold as seen” basis. These buyers may anticipate renovation work, but they still require accurate and honest information to make a decision – particularly when they intend to carry out structural surveys, damp inspections, or timber reports.

Being upfront from the beginning is not only a legal duty, but also a smart selling strategy. Transparent sellers:

- Reduce the risk of post-sale disputes

- Build credibility and trust with serious buyers

- Accelerate the sales process by removing uncertainty

- Attract buyers who are genuinely prepared for the renovation work involved

By completing the TA6 form with accuracy and disclosing all known issues early, sellers can facilitate a smoother transaction and appeal to buyers who are actively looking for renovation projects. In a market where trust is key, full disclosure becomes a competitive advantage when selling a poor condition flat.

If you’re planning on selling a poor condition flat in the UK, start by gathering all relevant documentation, including past surveys, repair history, and planning records. This proactive approach not only streamlines the sale but also demonstrates transparency and good faith to potential buyers.

Should I Renovate My Flat Before Selling It?

This is one of the most frequently asked questions when it comes to selling a flat in poor condition. The simple answer is: not necessarily. In many cases, it is entirely feasible – and sometimes more practical – to sell your flat without undertaking costly and time-consuming renovations.

In the UK property market, there is strong demand from investors, developers, and cash buyers who actively seek out properties that need modernisation or full renovation. These buyers are specifically looking for refurbishment projects or fixer-uppers that they can purchase below market value (BMV), renovate to their own standards, and either resell for profit or let out as rental investments.

While renovating your flat might increase its aesthetic appeal and potentially boost the asking price, it does not guarantee a higher net return. The cost of works can escalate quickly, particularly if unexpected structural issues arise during refurbishment. Sellers should be cautious about overcapitalising on renovations that may not be recouped in a final sale, especially in stagnant or slow-moving markets.

Additionally, a flat being sold in as-is condition may appeal more to buyers who prefer a blank canvas. These buyers often budget for refurbishment and may even be put off by recent works that don’t suit their style or standards. In this respect, leaving the property unmodernised and pricing it competitively can make more sense than trying to renovate before selling.

When deciding whether to renovate or not, consider these key factors:

- The current state of the flat and whether it is habitable or uninhabitable

- The expected cost of works versus the projected increase in sale price

- Your available time and budget to undertake a renovation

- The local demand for fixer-upper or BMV properties

- Whether the flat is suitable only for cash buyers due to mortgage restrictions

In summary, selling a flat in poor condition without renovating is not only acceptable – it is often the most realistic and financially sound choice. With proper positioning, clear marketing, and a fair price, you can attract the right buyers who see the potential and are willing to invest in bringing the property up to modern standards.

Selling Flat Fast As-Is UK: Pros and Cons

Selling a flat fast as-is in the UK is a practical solution for owners who want to avoid the cost, time, and stress of carrying out repairs or upgrades before putting their property on the market. This strategy is particularly relevant when selling a flat in poor condition, as it enables sellers to pass on renovation responsibility to the buyer – usually in exchange for a discounted price.

The as-is model means the property is sold in its current state, regardless of issues such as outdated décor, damp, structural problems, or even legal complications. This appeals to a specific subset of buyers: cash buyers, investors, developers, and those seeking below market value (BMV) opportunities.

Pros:

- Immediate Relief from Financial or Legal Burdens: If the flat is costing you in terms of mortgage payments, service charges, legal issues, or ongoing maintenance, a quick sale can offer immediate resolution.

- Attracts Investors and Cash Buyers: These buyers are actively looking for fixer-uppers, refurbishment projects, and problem properties. They are generally comfortable buying flats sold as seen.

- No Need for Upfront Spending on Refurbishment: You save time and money by avoiding renovation work, which is particularly helpful if you lack the budget for a full renovation or if the flat is uninhabitable.

- Faster Completion Time: With no mortgage involved, cash sales tend to complete more quickly, which is ideal for urgent sales or chain-free transactions.

Cons:

- Lower Sale Price: Buyers will expect a discount to compensate for the risk and the cost of works required. The property will almost certainly sell below market value.

- Reduced Buyer Pool: Traditional buyers who require a mortgage may not qualify if the flat fails valuation or is considered non-livable.

- Valuation and Legal Issues: Mortgage lenders, surveyors, and solicitors may flag issues with the flat’s condition or legal status, even for cash buyers, potentially causing delays or renegotiations.

- Buyer Expectations: Even investors can be cautious. If defects are underdisclosed or the scope of work is unclear, you may face renegotiation after surveys or risk the buyer withdrawing altogether.

Ultimately, selling a flat in poor condition fast and as-is is a viable and increasingly popular strategy in the UK. While you may not achieve the highest price, the process can be more predictable and efficient – especially when dealing with unmodernised, run-down, or derelict flats. By being honest, pricing realistically, and targeting the right buyer profile, you can still achieve a successful sale with minimal friction.

Valuing a Poor Condition Flat

When selling a flat in poor condition, it’s essential to understand how its state can directly impact its market value. While size and location are key drivers, the condition of the property is often what sways a buyer’s final decision – especially in a competitive market.

Flats that are well-maintained, recently updated, or move-in ready will usually achieve higher asking prices. Buyers see value in a home that requires little to no work, and they’re often willing to pay more to avoid the hassle of renovations.

On the other hand, selling a flat in poor condition – whether due to outdated décor, worn fixtures, damp issues, or more serious structural problems – can reduce buyer interest and lower the price considerably. Buyers tend to overestimate repair costs, which leads them to negotiate more aggressively or avoid the property altogether.

In many cases, a tired or neglected flat may sit on the market for longer, particularly if it’s overpriced or not marketed transparently. Buyers today are savvy; if the property doesn’t match the listing description or asking price, they’re likely to move on.

To improve your chances of success when selling a flat in poor condition, be upfront about any issues and ensure your pricing strategy reflects the reality of the situation. This will not only help build trust but also attract serious interest from the right type of buyer – often cash buyers or investors looking for a renovation project.

When selling a flat in poor condition, one of the most critical decisions you’ll make is setting the right asking price. A property in need of work will naturally attract a different type of buyer – usually investors, cash buyers, or developers – who are seeking value and potential for future profit.

Overpricing a flat in poor condition can quickly turn away serious interest. Buyers will compare your property with other local listings and recent sales, and if it doesn’t stack up, they’ll either negotiate aggressively or look elsewhere.

Start by getting a realistic, local valuation from estate agents experienced in selling rundown or neglected properties. They’ll have up-to-date knowledge of what similar homes are fetching and can offer valuable insights into buyer expectations in your area.

Research the sold prices of comparable ‘fixer-upper’ flats nearby. This market data gives you a clear benchmark and ensures your flat is priced competitively. Remember, online listing prices can be misleading-sold prices reflect what buyers are actually willing to pay.

If the property has major issues – such as damp, subsidence, or outdated electrics – consider commissioning a pre-sale survey. This can:

- Identify key structural or cosmetic problems that may affect value

- Support your pricing with objective, independent evidence

- Demonstrate honesty and transparency to prospective buyers

Buyers looking to take on a renovation project will also factor in their anticipated costs and desired profit margins. Your asking price should leave room for them to refurbish and still see a return on their investment.

Ultimately, the best pricing strategy for selling a flat in poor condition is one that is honest, data-driven, and flexible. A realistic price attracts attention, generates offers more quickly, and gives you a stronger position when negotiating.

Being strategic doesn’t mean undervaluing your flat – it means recognising its true worth in its current state and aligning that with what buyers are prepared to pay.

Setting the right price is essential when selling a flat that needs work. Most buyers – particularly cash buyers and investors – are looking for a deal that accounts for the time, effort, and cost of bringing the property up to standard. If your asking price doesn’t reflect the reality of the flat’s condition, you risk deterring serious interest.

Start by getting a professional valuation from local estate agents with experience in selling similar properties in need of renovation. Their insights can help you understand what buyers in your area are realistically prepared to pay.

Next, research recent sale prices of comparable ‘fixer-uppers’ nearby. This gives you a benchmark and helps ensure your pricing is competitive in the current market.

For flats with significant issues, it may be worth commissioning a pre-sale survey. This can:

- Identify major defects that may affect the value

- Provide independent evidence to support your pricing

- Reassure potential buyers by showing transparency

Remember, investors and cash buyers will factor in the cost of repairs and their expected return on investment. Your pricing should leave enough margin for them to see value, without undervaluing the property entirely.

In short, take an evidence-led and pragmatic approach to pricing. A fair, realistic price not only attracts attention but also increases your chances of securing a quicker, hassle-free sale.

Who Buys Run-Down Properties in the UK?

Understanding who your potential buyers are is essential when selling a flat in poor condition. Properties that are run-down, unmodernised, or in need of full renovation often require a different sales strategy than those in turnkey condition. These types of flats appeal to a niche segment of the market – buyers who are willing to take on the risks, costs, and work involved in bringing a property up to standard.

Key buyer types include:

- Professional Property Investors and Landlords – These buyers are usually portfolio landlords or individuals looking to acquire properties at below market value (BMV) for long-term capital appreciation or rental yield. They are comfortable purchasing flats in as-is condition, even when a full renovation is required, and are often well-versed in planning permission, building control, and refurbishments.

- Property Developers – Developers actively seek run-down or derelict flats that represent refurbishment projects. They typically aim to renovate and resell the flat at a profit or convert it into rental units. These buyers may be interested in properties that need structural work or are sold as seen, especially if the location has gentrification or regeneration potential.

- Quick Sale and Cash Buying Companies – These firms specialise in purchasing flats in poor condition quickly and with minimal fuss. Their offers are usually lower than open market value, but they can complete in a matter of days or weeks. Ideal for sellers who need to sell fast and without undertaking any repairs.

- Auction Buyers – Flats in poor condition are frequently listed at property auctions. Buyers here are typically experienced investors or developers looking for uninhabitable or shell condition flats that they can transform into profitable assets. Auction sales are fast, transparent, and legally binding.

- First-Time Buyers with Renovation Ambitions – A smaller segment, but still relevant, these buyers are often priced out of fully renovated flats and see a fixer-upper as a way to get on the ladder. While not always cash buyers, some may have renovation budgets and be open to purchasing flats that need TLC.

When selling a flat in poor condition, targeting these specific groups and understanding what motivates them can make all the difference. Marketing materials should clearly outline whether the property is mortgageable, the scope of work required, and whether it is sold as seen. Doing so helps attract serious interest from the right buyers and increases the likelihood of a successful transaction.

Common Issues When Selling a Flat in Poor Condition

Selling a flat in poor condition in the UK can be far more complicated than selling a standard home. Poor-condition flats – whether unmodernised, structurally unsound, or requiring full renovation – face a unique set of market and legal obstacles that sellers must be prepared to handle. Understanding these common issues is vital to manage expectations and avoid costly delays.

Reduced Buyer Interest: One of the primary challenges is limited demand. Many buyers are seeking properties they can move into immediately. A flat needing TLC or a full refurbishment is likely to attract fewer viewers unless priced attractively and targeted at the right demographic (e.g. investors or cash buyers).

Mortgage Restrictions: Flats in poor condition often fail to meet minimum standards required by mortgage lenders. Issues such as damp, missing facilities, or structural movement can result in failed mortgage valuations. This restricts your market to cash buyer only prospects, significantly narrowing the buyer pool.

Negative Survey Results: Surveyors are thorough when evaluating problem properties, and the reports they produce can lead to buyer hesitation, renegotiation, or complete withdrawal from the sale. Structural issues, roof damage, or the need for a damp and timber report can raise red flags and impact the buyer’s perception of value.

Legal Disclosure Obligations: UK law mandates that sellers disclose any known defects under the Consumer Protection from Unfair Trading Regulations. If your flat is uninhabitable, sold as seen, or has existing planning or building control issues, these must be fully disclosed. Failure to do so could result in legal claims.

Listed Building Constraints: If the flat is in a listed building, any internal or external alterations – past or proposed – may require listed building consent. This can complicate both the marketing and sale process, especially if unapproved works have already been carried out.

Buyer Confidence and Negotiation: Buyers expect transparency, and uncertainty over the cost of works can lead to aggressive price negotiations. Even cash buyers will seek substantial discounts to account for potential risks. Preparing a snagging list or commissioning independent reports can help manage this.

In summary, selling a flat in poor condition requires a proactive, transparent approach. The more prepared and honest you are, the more likely you are to secure a serious buyer – even if the property is classified as a fixer-upper, derelict, or a refurbishment project.

Problems When Selling Through an Estate Agent

Selling a flat in poor condition through a traditional estate agent can present a number of unique challenges. While estate agents are experts at selling mainstream properties, many are less enthusiastic or equipped when it comes to marketing a flat that is unmodernised, structurally compromised, or uninhabitable.

Buyers Expect Large Discounts: One of the first hurdles is price negotiation. Buyers introduced through estate agents often expect to negotiate aggressively on price – particularly when the property requires significant refurbishment. A flat described as a fixer-upper or needing TLC will often invite offers well below the asking price.

Survey Results Can Collapse the Sale: After an offer is accepted, the buyer will usually commission a structural survey. For flats in poor condition, these surveys frequently uncover costly or complex issues that may not have been apparent during viewings. This can lead to buyers withdrawing from the sale or demanding steep reductions in price, sometimes at the eleventh hour.

Limited Marketing Effort: Some estate agents may deprioritise flats in as-is condition, seeing them as harder to sell. If a flat is uninhabitable or in shell condition, agents might avoid promoting it as actively as they would a turnkey home. Photos may be limited, descriptions vague, and viewings difficult to arrange.

Reduced Viewing Access: Poor-condition flats can be difficult to show due to safety concerns, lack of power, or the presence of hazards like damp or mould. Agents may restrict access or struggle to conduct viewings in their usual manner, which can reduce buyer interest and delay progress.

Mortgage Issues and Buyer Qualification: Estate agents typically work with a broad audience, including first-time buyers and those relying on mortgage finance. If the property is unmortgageable due to its condition, agents may waste time engaging unqualified buyers, leading to delays and failed transactions.

In summary, while estate agents can play a valuable role, selling a flat in poor condition through them often requires proactive oversight from the seller. You may need to push for more honest marketing, ensure buyers are pre-qualified (ideally cash buyers), and prepare for renegotiation following surveys. For some sellers, alternative routes such as auctions or direct-to-investor platforms may be more effective for this type of sale.

Steps to Take When Selling a Run-Down Flat

When selling a flat in poor condition, taking a structured, informed, and proactive approach is essential to overcome market challenges and attract serious interest. Poor-condition flats – including those that are unmodernised, derelict, or in shell condition – present unique obstacles, but with the right strategy, they can also offer significant opportunities for both seller and buyer.

Selling a run-down flat is rarely a straightforward process. These properties often suffer from a combination of issues – such as outdated systems, aesthetic deterioration, legal complications, or external building defects – that make them less attractive to traditional buyers. As a result, they must be marketed and presented in a way that appeals to the right audience, typically cash buyers, investors, and developers looking for fixer-uppers or refurbishment projects.

Legal preparedness is critical when selling a flat in poor condition. Documentation such as lease details, planning permission history, building control approvals, and a valid EPC must be in place. Furthermore, sellers are legally required to disclose all known defects and issues to avoid falling foul of UK consumer protection laws.

Equally important is market realism. Sellers must understand that a flat in need of modernisation or full renovation will command a lower price than a turn-key property. Setting a realistic asking price based on the as-is condition – and backed by a recent valuation or building survey – can help attract serious offers and speed up the sales process.

Finally, transparent and accurate marketing can make or break the sale. Being upfront about what work is needed and using clear terminology like “sold as seen,” “TLC required,” or “investment opportunity” not only builds trust but also filters out unsuitable buyers. With the right preparation and positioning, even the most challenging flats can find the right buyer and achieve a successful outcome.

- Set a Realistic Price – Setting the right price is one of the most critical steps when selling a flat in poor condition. Buyers of run-down or unmodernised flats will expect to take on the cost, time, and risk of refurbishment, and will factor this into any offer they make. Start by obtaining a professional valuation or market appraisal that reflects the property’s as-is condition. Factor in any limitations such as structural defects, poor EPC ratings, or the fact that the property may be unmortgageable – making it suitable for cash buyers only.

When pricing, consider the likely cost of works the buyer will need to carry out. These may include plumbing or electrical upgrades, damp treatment, replacing windows or roofs, or full internal renovations. Deduct these estimated costs from the flat’s potential post-renovation value to arrive at a fair and competitive asking price. This approach will help ensure the property is priced below market value (BMV), which is often the key attraction for investors and developers.

A realistic and well-justified price not only generates more interest but also reduces the risk of price renegotiations later in the process. In the context of selling a flat in poor condition, accurate pricing is essential to achieve a fast and credible sale, especially in competitive markets where buyer confidence depends on perceived value and transparency.

- Sell to a Target Market – When selling a flat in poor condition, it’s essential to direct your efforts toward buyers who are actively looking for properties in need of work. These include professional investors, cash buyers, developers, and renovation-minded buyers who specialise in purchasing below market value (BMV) opportunities. This demographic is less concerned with aesthetics and more focused on the flat’s potential post-renovation value.

Tailor your marketing materials to appeal directly to this audience. Use clear and specific language such as “fixer-upper,” “investment opportunity,” “refurbishment project,” or “full renovation required.” Include details about square footage, development potential, planning permission status, and whether the property is mortgageable or cash buyer only. Be transparent about any structural issues or compliance shortcomings, as seasoned investors will expect full disclosure.

Additionally, consider listing your flat on platforms that cater to investment buyers or property auctions, where interest in run-down or derelict flats is often higher. The more targeted your approach, the more likely you are to attract the right buyer who is prepared – and motivated – to take on the project.

- Be Honest in Marketing – Transparency is one of the most effective tools when selling a flat in poor condition. Buyers – particularly cash buyers and investors – value honesty and clarity about the extent of the work required. Accurately describing the flat’s current as-is condition is essential, including disclosing known defects such as structural issues, outdated or unsafe plumbing and electrics, visible damp, roof leaks, or compliance shortfalls.

Avoid vague language and instead use direct, informative descriptions. Phrases such as “full renovation required,” “sold as seen,” “unmodernised condition,” “TLC needed,” or “refurbishment opportunity” help set realistic expectations and attract buyers who are specifically looking for fixer-uppers or investment projects.

Supporting your marketing with clear, unfiltered photographs, floorplans, and – if available – surveys or quotes for works will further demonstrate transparency and build buyer confidence. This not only streamlines the sales process but also reduces the likelihood of renegotiation or collapse later on. When selling a flat in poor condition, clear and honest marketing helps you reach the right audience and secure a credible, committed buyer.

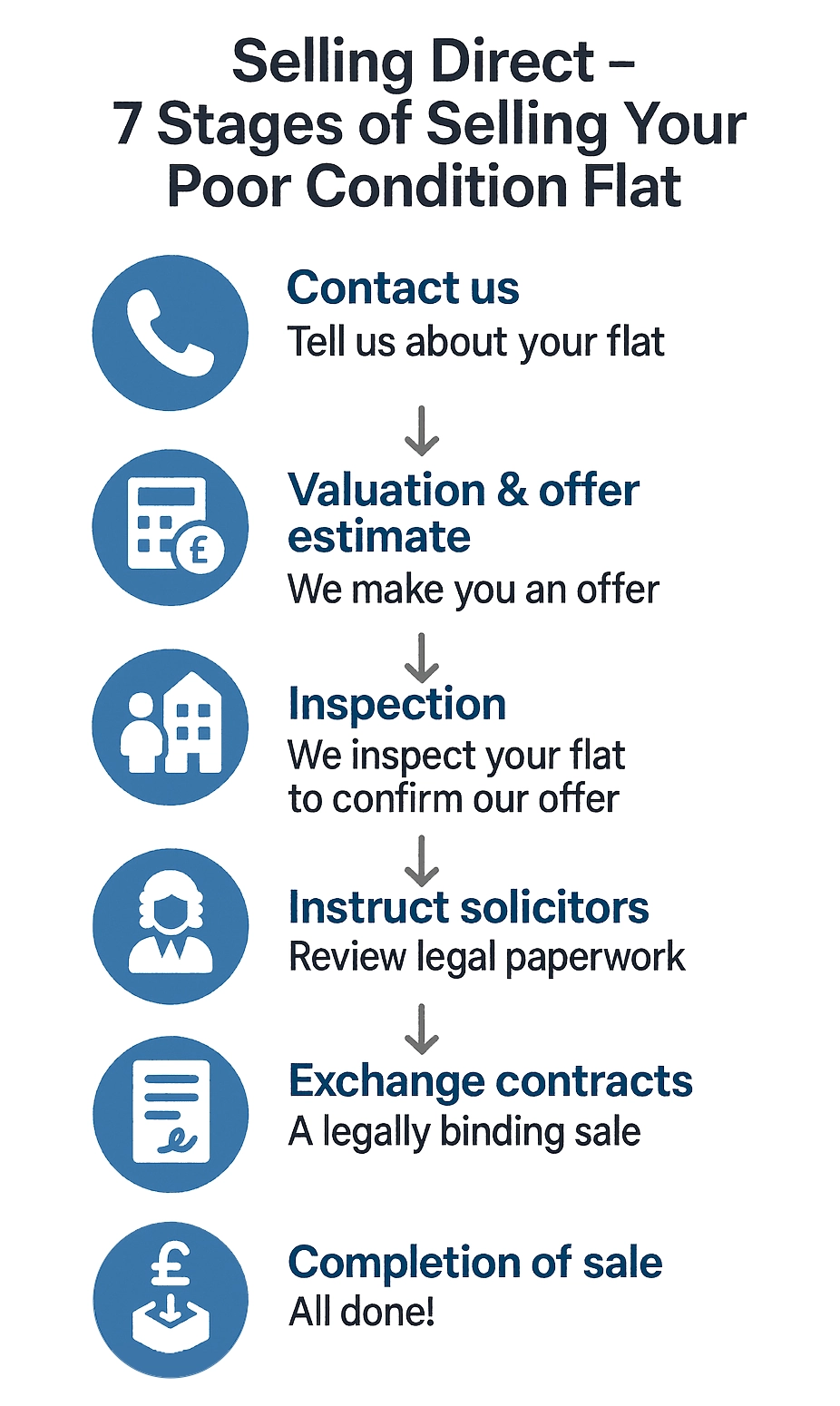

- Consider a Quick Sale Company – When selling a flat in poor condition, particularly if you’re looking for a fast and guaranteed sale, using a quick sale company can be a highly practical option. These companies specialise in purchasing properties in as-is condition, including unmodernised, derelict, or even uninhabitable flats that would struggle to sell through traditional estate agency channels.

Quick sale companies offer certainty and speed, often completing transactions in as little as 7 to 28 days. This route can be ideal if you’re facing time-sensitive situations such as probate, financial pressure, divorce, or the risk of repossession. Since most of these buyers are cash-funded, the sale is not dependent on mortgage approvals, reducing the risk of delays or fall-throughs due to lending issues.

However, sellers must be aware that offers from quick sale companies are typically below market value (BMV) to account for the cost of works and the company’s own margin. That said, the trade-off is often worthwhile for those prioritising a no-fuss, reliable exit.

If you choose this route, ensure the company is reputable, registered with a professional body, and transparent about their fees and process. For sellers aiming to offload a flat in poor condition quickly and without renovation, a quick sale company can offer a valuable alternative to the open market.

- Legal and Leasehold Factors – When selling a flat in poor condition, legal and leasehold considerations play a crucial role in determining how smoothly the sale will progress. Flats that are leasehold – especially those that are run-down or in need of refurbishment – can present added complexities that must be addressed upfront to reassure potential buyers and avoid delays.

Start by gathering all essential legal documentation, including a copy of the lease, ground rent and service charge history, details of any major works (past or planned), building control certificates, and planning permission approvals for any alterations. Buyers of poor-condition flats will want to understand both the current physical condition and the legal standing of the property.

Flats with leasehold complications – such as short leases (typically under 80 years), missing or absent freeholders, unapproved alterations, or unresolved disputes – require extra care. These issues can deter mortgage lenders, limiting the buyer pool to cash buyers only, and can impact the property’s valuation. In some cases, a flat may not be sellable until these legal matters are resolved.

It is also important to ensure compliance with building regulations, especially if the flat has undergone any structural work or conversions without proper oversight. A lack of formal approvals can lead to delays or even aborted sales if buyers or their solicitors raise concerns.

For maximum transparency, provide a solicitor’s pack early in the process or work with a conveyancer experienced in dealing with poor-condition and leasehold flats. Taking a proactive approach to legal preparation will instil confidence in buyers and help you avoid problems further down the line when selling a flat in poor condition.

- Clear and Declutter – First impressions still matter, even when selling a flat in poor condition. Regardless of whether the flat is unmodernised, run-down, or in shell condition, taking time to clear and declutter can significantly impact how the property is perceived by potential buyers. Remove all rubbish, outdated furniture, broken fittings, personal belongings, and anything that may obstruct views of the layout or key features such as windows, storage, or room proportions.

While the property may require extensive refurbishment, a clean and uncluttered space allows buyers – especially investors and developers – to visualise its potential more clearly. It reduces psychological resistance by showing that the flat is manageable and accessible for renovation. This is particularly important when targeting cash buyers or those interested in fixer-upper projects, as they will be looking to assess scope, structure, and value-add potential during viewings.

Even simple steps like sweeping floors, removing mouldy carpets, or airing out musty rooms can help buyers see beyond the current condition. In the context of selling a flat in poor condition, presenting the property in a tidy, accessible, and honest way enhances its marketability and can help speed up the sales process.

- Highlight Redeemable Features – When selling a flat in poor condition, it’s essential to showcase the property’s redeeming qualities to balance out its shortcomings. Even run-down or unmodernised flats often have features that can make them attractive to the right buyer. Focus on elements such as spacious room layouts, high ceilings, natural light, original period features, or south-facing aspects that add value despite the overall condition.

Location advantages should also be highlighted prominently. Proximity to transport links, popular schools, employment hubs, or areas undergoing regeneration can make even a derelict or shell condition flat appealing to investors and developers. Buyers looking for fixer-uppers or refurbishment projects are often more concerned with future potential than current condition, so selling a vision of what the property could become is a powerful strategy.

Additionally, if the flat is structurally sound or has recently had certain updates – such as new windows or a compliant electrical system – be sure to include this in your marketing. These features can reduce the perceived renovation burden for the buyer and justify a higher offer.

When selling a flat in poor condition, effective marketing involves not just honesty about the defects but also enthusiasm about the possibilities. Highlighting redeemable features helps potential buyers see beyond the work required and focus on the value they can unlock.

- Understand EPC and Compliance Issues – When selling a flat in poor condition, it’s important to consider how the property’s energy efficiency and legal compliance will impact the sale. Flats that are outdated or unmodernised often perform poorly on their Energy Performance Certificate (EPC), which is a legal requirement for all residential sales in the UK. A low EPC rating can raise red flags for buyers and may limit your pool of potential purchasers – particularly if the flat is being marketed to landlords, who must meet minimum EPC standards for rental properties (currently Band E in England and Wales).

EPCs assess key elements such as insulation, heating systems, glazing, and ventilation. Poor-condition flats often lack proper insulation or have inefficient boilers and single-glazed windows, all of which contribute to a substandard energy rating. Buyers will factor this into their renovation budget, especially if they’re intending to let the property.

It’s also wise to review compliance issues beyond energy efficiency. Building control approval may be required for previous alterations or any unauthorised structural work. Planning permission records, gas safety certificates, and electrical installation reports may also be scrutinised during the conveyancing process. Lack of documentation or unresolved compliance issues can lead to delays, renegotiations, or lost sales.

To strengthen your position when selling a flat in poor condition, obtain an up-to-date EPC and highlight any recent improvements, such as a new boiler or insulation. This can help reassure buyers about the property’s upgrade potential and guide them on what improvements may be eligible for government grants or financing.

In summary, understanding and addressing EPC and compliance issues is vital when marketing a poor-condition flat, especially if you want to attract serious, informed buyers who can see the long-term value in the property.

- Prepare for Mortgage Issues – One of the most significant challenges when selling a flat in poor condition is securing a buyer who can obtain mortgage financing. Mortgage lenders in the UK have strict criteria regarding a property’s habitability and condition. Flats that suffer from structural issues, serious damp, non-compliant electrics, missing kitchens or bathrooms, or other health and safety concerns often fail to meet lending standards. As a result, traditional buyers who rely on mortgage finance may not be eligible to purchase your flat.

If your flat is unmodernised, uninhabitable, or sold in as-is condition, be proactive in identifying its mortgage limitations early on. Clearly state in your listing whether the flat is suitable for cash buyers only. This helps avoid wasted time with ineligible viewers and ensures you’re targeting the right audience – typically investors, developers, or quick-sale companies.

You may also wish to obtain a valuation or consult with a mortgage broker to assess whether your property is mortgageable. Understanding the potential obstacles in advance allows you to plan accordingly and increases the chances of a smoother sale. When selling a flat in poor condition, managing buyer expectations around mortgage eligibility is key to securing a committed buyer and avoiding failed transactions.

By following these steps, you can maximise your chances of selling a flat in poor condition efficiently and responsibly. Whether it’s a derelict flat, a cosmetic fixer-upper, or a problem property, a structured and honest approach is key to reaching the right buyers and closing the deal.

Probate and Inherited Flats

Selling a flat in poor condition that has been inherited through probate brings both emotional and legal challenges, particularly when the property has not been maintained for an extended period. Many inherited flats fall into disrepair due to the previous owner’s declining health or long-term vacancy. These flats are often unmodernised, suffer from neglect, or are entirely uninhabitable – making them prime candidates for sale as fixer-uppers or refurbishment projects.

The first step in legally selling an inherited flat in the UK is obtaining a Grant of Probate. This court-issued document confirms the authority of the executor or administrator to manage the deceased’s estate. Without this grant, the legal sale of the flat cannot proceed. However, it is possible to list the property and begin the marketing process before the grant is issued, as long as prospective buyers are informed of the timeline.

Selling a probate flat in poor condition often means selling it in as-is condition. Families may not have the resources or time to carry out necessary improvements, and investors understand this. Marketing the flat as an investment opportunity, sold as seen, or below market value (BMV) helps attract developers and cash buyers who are comfortable handling renovation work.

Probate flats often present additional challenges such as:

- Utility arrears or council tax liabilities accrued while the flat remained empty

- Security concerns, particularly if the flat is obviously vacant

- Missing compliance documentation, such as planning permission, building control approvals, or electrical/gas safety certificates

- Disagreements among heirs, especially when multiple beneficiaries must agree to the sale terms

When selling a flat in poor condition through probate, it is advisable to instruct a solicitor experienced in both probate and property sales. Estate agents should be briefed on the property’s history and instructed to market it clearly as a renovation project. Including documentation like a structural survey, EPC, or damp and timber report can provide reassurance to prospective buyers and reduce the chances of post-offer renegotiation.

In essence, probate sales of poor-condition flats require a careful blend of legal compliance, clear communication, and strategic marketing. By being upfront about the flat’s limitations while showcasing its potential, sellers can appeal to the right buyer demographic and navigate what is often a sensitive transaction with greater confidence and success.

Short Lease and Poor Condition – A Double Hit

Selling a flat in poor condition is already a complex task, but when that flat also has a short lease – typically defined as having less than 80 years remaining – it presents a double challenge that significantly affects both valuation and buyer interest. This combination of physical disrepair and legal limitation can drastically narrow your buyer pool, reduce mortgage eligibility, and lower the achievable sale price.

Mortgage lenders are often unwilling to finance properties with short leases, especially if the flat is also uninhabitable or in need of major renovation. This means most sales will need to be to cash buyers only, who will expect a discount that reflects not just the cost of refurbishment but also the future cost and complexity of extending the lease.

Lease extensions can be expensive, particularly when the lease term drops below 80 years, as marriage value – the increase in value following an extension – must be paid to the freeholder. Buyers will factor this into their offer, further driving down the price. If the flat also requires modernisation or a full refurbishment, these costs combined can make the property financially viable only to experienced investors or developers.

When selling a flat in poor condition with a short lease, transparency is crucial. Ensure you have a copy of the lease available, and consider getting an estimate or formal quote for the cost of extending it. Some sellers may choose to initiate the lease extension process themselves to make the property more marketable, though this will depend on time and budget constraints.

In your marketing, clearly indicate the lease length and state whether it’s suitable for cash buyers only. Highlight any redeemable features – such as location, layout, or development potential – and present the flat as a below market value (BMV) opportunity with significant upside for the right buyer.

In summary, the combination of a short lease and poor condition significantly reduces traditional buyer interest, but it doesn’t make a sale impossible. With strategic pricing, legal preparedness, and clear marketing, these types of properties can still find the right buyer in today’s market.

Selling a Flat in Poor Condition in London: Key Differences

Selling a flat in poor condition in London brings its own set of complexities and opportunities. The capital’s property market is unique in terms of pricing, demand, property types, and regulatory considerations. Sellers must understand how these localised factors can influence the sale of a fixer-upper, unmodernised, or derelict flat.

- Higher Base Values – London’s high average property prices mean that even a flat in poor condition can achieve a comparatively strong sale price. While buyers will still expect a discount for refurbishment work, the baseline value of the location may offset some of the cost of works. This makes poor-condition flats attractive investment opportunities in areas undergoing regeneration or with strong transport links.

- Ex-Council and High-Rise Stock – Many of London’s run-down flats are found in ex-local authority buildings or high-rise blocks. These properties are frequently leasehold and often come with additional legal and maintenance considerations. Selling a flat in poor condition within these blocks may require navigating communal repair obligations, restrictive covenants, or historic service charge disputes.

- Lease and Freeholder Complexity – London flats are predominantly leasehold, and the involvement of managing agents, housing associations, or absentee freeholders can create delays or complications. Approval for alterations, unresolved maintenance work, or Section 20 notices for major repairs can all affect saleability.

- Greater Buyer Scrutiny – London buyers – especially investors and developers – are typically more experienced and cautious. They will expect full disclosure of any issues, and are likely to commission thorough surveys, including structural reports, damp and timber inspections, and EPC analysis. Transparency is vital when marketing to this audience.

- Regeneration or Gentrification – Poor-condition flats located in up-and-coming areas of London may benefit from wider urban development schemes or rising local demand. Buyers may be willing to overlook current condition issues in anticipation of future capital growth. Sellers should leverage any regeneration context to bolster interest.

- Different Sales Routes – In London, auction houses and investment-focused estate agents are more commonly used for selling poor-condition flats. These platforms attract cash buyers looking for refurbishment projects and allow sellers to avoid prolonged open-market exposure.

- Access and Space Issues – Flats in London are often constrained by limited internal space, lack of outdoor areas, or poor access in older or high-rise buildings. These practical limitations can compound condition-related concerns. Highlighting redeemable features like layout potential, natural light, or views can help overcome objections.

Overall, selling a flat in poor condition in London requires a highly strategic approach that takes into account the capital’s competitive, diverse, and nuanced property market. With the right pricing, legal preparation, and buyer targeting, even a severely run-down flat can achieve a successful outcome in this high-demand urban environment.

FAQs: Selling a Flat in Poor Condition

- Can I sell a flat in poor condition without renovating it?

Yes, you can sell a flat in poor condition without making renovations. Many buyers – especially cash buyers and investors – actively seek refurbishment projects and fixer-uppers sold as-is. - What does selling a flat in poor condition ‘as-is’ mean?

Selling a flat ‘as-is’ means it is sold in its current state, with no repairs or updates made by the seller. Buyers accept the risks and are responsible for all renovation work post-sale. - Who buys flats in poor condition in the UK?

Common buyers include property investors, landlords, cash buyers, developers, and quick sale companies. These groups often look for below market value (BMV) opportunities that need modernisation or a full renovation. - Is it hard to get a mortgage on a flat in poor condition?

Yes, mortgage approval is often difficult for flats in poor condition, especially if the property is uninhabitable or structurally unsound. Many such sales are limited to cash buyers only. - How should I price a flat in poor condition?

When selling a flat in poor condition, price it to reflect the as-is value, accounting for the cost of required repairs and any mortgage restrictions. A professional valuation can help determine a realistic price point. - Do I need to disclose defects when selling a flat in poor condition?

Yes, UK law requires you to disclose any known defects, including structural problems, damp, or compliance issues, when selling a flat in poor condition. - Is auction a good option for selling a poor condition flat?

Yes, auctions are a popular route for selling run-down or unmodernised flats, as they attract cash buyers and provide a fast, legally binding sale. - Can I sell an inherited flat in poor condition before probate is granted?

You can market the property, but you cannot legally complete the sale until probate is granted. Transparency with buyers about the timeline is essential. - How does a short lease affect the sale of a poor condition flat?

A short lease can further limit buyer interest and mortgage eligibility, making the flat less attractive unless priced accordingly and targeted at cash buyers. - What is the best way to market a flat in poor condition?

Use clear, honest language like “sold as seen,” “TLC needed,” or “refurbishment opportunity,” and highlight redeemable features such as location, space, or future value.